The New Risk in Office Is the Landlord

Why ‘de-risking’ your building is now the riskiest move.

Many landlords believe they have “de-risked” their office assets with flex.

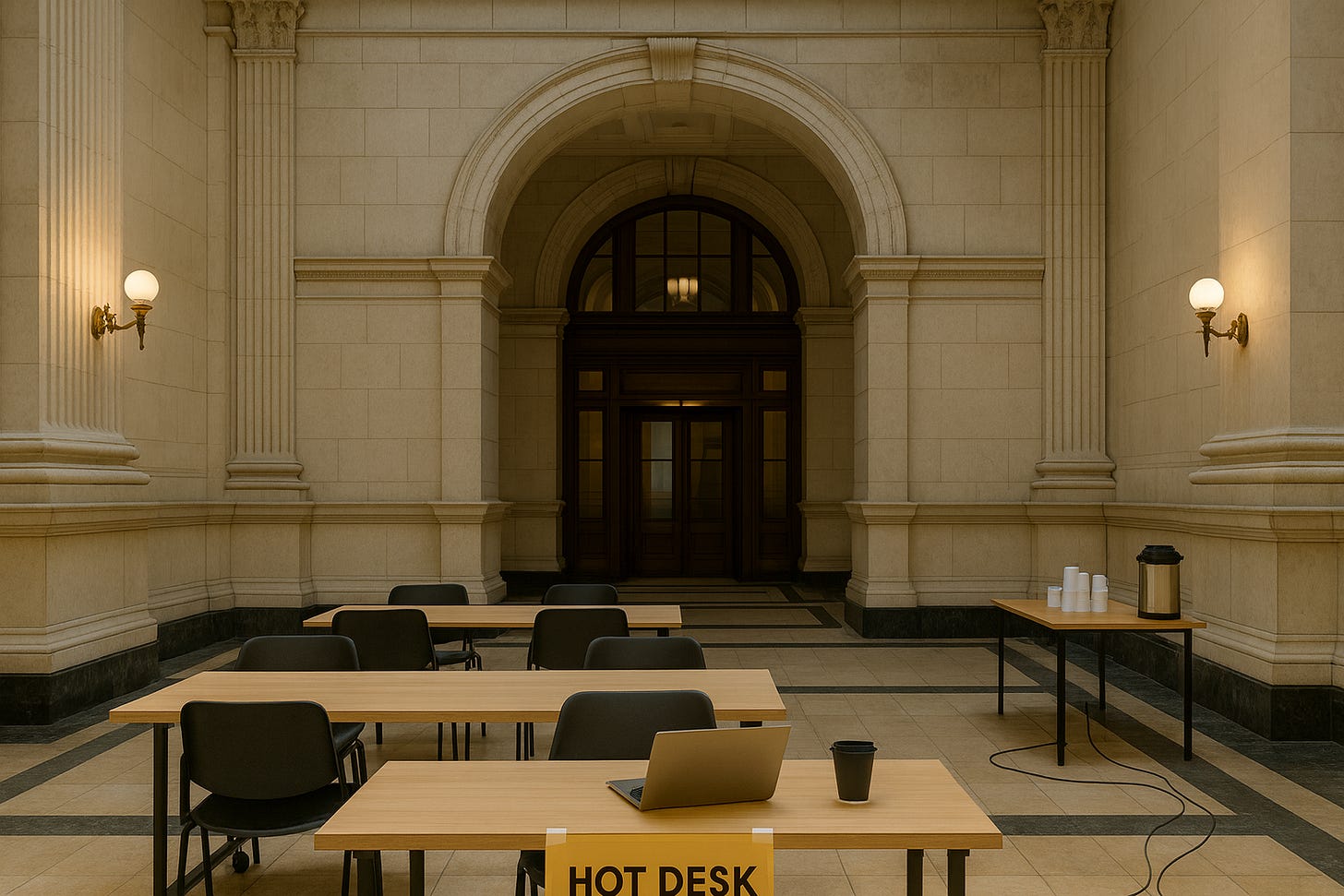

After investing £XXM+ on the refurbishment of their prestigious office building, they sign a fixed lease with a mid market flex operator.

✔️ Flex office amenity tick box accomplished.

Internally, that gets reported as stability:

Lower capex exposure

Guaranteed income

No operating ob…