BXP (formerly Boston Properties) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States

Brave Ideas Season 15, Episode 9

This episode is made possible by ReturnSuite:

”Complex Cash Flow Modeling Simplified.”

Future-proofing premium offices with flex and clusters

In this episode, Brave Corp CEO, Caleb Parker, and ReturnSuite Cofounder, Sam Gamble tee up a deep dive in the Brave Ideas Virtual Studio with Bryan Koop, EVP of BXP in Boston, Massachusetts (USA).

We unpack how BXP defines “premium” around client performance and productivity, why concentrated cluster ownership outperforms one-off assets, and how in-building flex footprints de-risk churn, smooth demand, and protect NOI.

Koop shares what footprint size is allocated to flex inside their 1–2M SqFt assets, why secure IT and modular walls matter for spec suites, and how percentage-rent structures with F&B operators align incentives.

We close with how BXP secured a 70% pre-let in Washington, DC, delivering a redevelopment built almost from scratch to modern specs, their building wide club strategy that removes friction for customers, and a pragmatic take on sustainability that favours measurable execution over slogans.

What You’ll Learn in This Episode

How to evaluate “premium” beyond finishes, focus on productivity, service, and flexibility that customers will pay for

Why cluster strategy lifts occupancy and pricing power; move customers inside the ecosystem with less friction

How to right-size and operate flex inside major assets, including spec-suite design, IT security, and modularity

How percentage-rent deals work for restaurants, and when similar logic can apply to flex footprints

How BXP approached a 70 percent pre-let repositioning in DC to deliver light, height, and healthier systems

Key Takeaways for Operators

Design spec suites for instant move-in, enterprise-grade connectivity, and quick reconfiguration with modular walls

Use in-building flex as lead generation and a bridge during build-outs; incubate growth and retain customers

Deploy building-wide clubs and meeting suites to lift experience, reduce friction, and support customer success

Key Takeaways for Real Estate Investors

Underwrite flex as a core layer that absorbs volatility; 30–40K SqFt per 1–2M SqFt asset can defend NOI

Favour clusters; concentrated ownership enables placemaking, amenity sharing, and easier internal migrations

Expect hybrid income; percentage-rent and management-style structures require auditable breakpoints and clear covenants

Back modern specs; higher ceilings, light, and healthy systems can outperform even in supply-heavy markets

CONNECT

Behind the Scenes

Special THANK YOU to

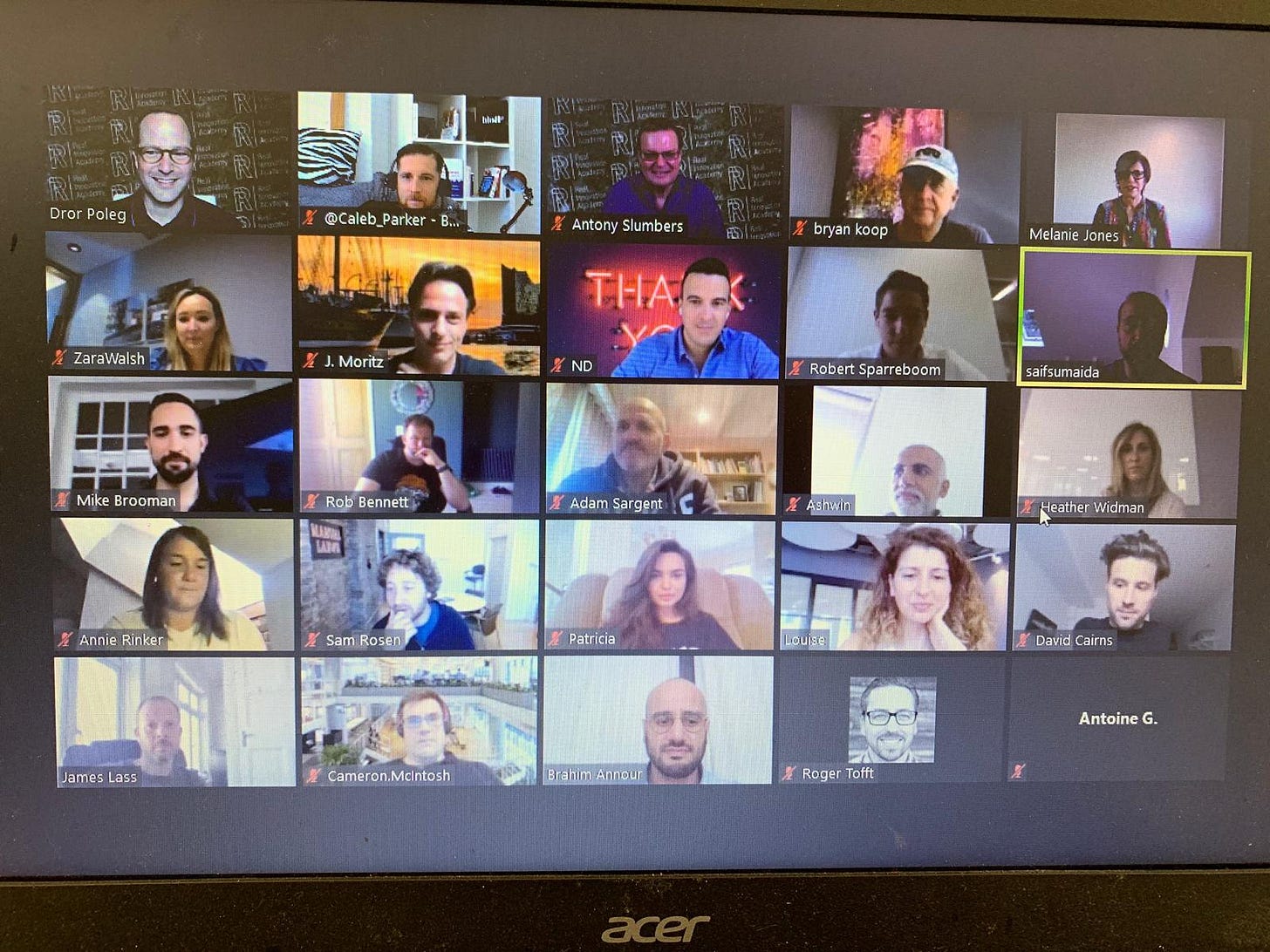

& for introducing Bryan Koop & Caleb Parker.Can you spot Caleb & Koop below?

💡 This episode is part of Brave Ideas Season 15, exploring brave ideas shaping the future of office real estate, Space-as-a-Service, and workplace experience.

Join the Conversation

🎧 Listen now and see how BXP’s cluster strategy, in-building flex at 30,000-40,000 SqFt per 1–2M SqFt asset, and percentage-rent F&B can protect NOI and elevate the premium office playbook; then drop a comment with your favourite soundbite. #PlusNotVersus