The Party Is Over: Welcome to the Era of Operational Grit

Observations for Flexible Workspace Operators in 2026

Let’s be honest, we’ve all had enough of the crystal ball gazing.

For the better part of a decade, the flexible workspace industry has been drunk on hype, fuelled by headlines about the ‘death of the office’ or the ‘universal return to the CBD’.

The press articles promised a revolution,

but the reality delivered little more than a rebrand.

Well, the hangover is finally gone.

As we settle into 2026, the dust has settled on the Return to Office (RTO) wars, and the ‘land grab’ era of speculative expansion is dead.

We aren’t doing valuation multiples based on potential anymore; we are doing unit economics.

2026 isn’t just another year of growth;

it’s the year the industry finally grew up.

We have entered the era of Operational Grit.

The New Boss

The biggest shift in our rent roll isn’t the digital nomad, it’s the Enterprise client.

Companies with 200+ staff are flooding into flex, looking for agility.

On the surface, this looks like a massive win - who doesn’t want that creditworthiness on the books?

This shift has introduced the Ghost Negotiator.

You are no longer closing deals over a craft beer with a founder who loves the vibe of your breakout space. You are negotiating with a procurement team in Singapore, London or New York who has never stepped foot in your incredible space.

They don’t care about your community events - they care about ISO certifications, cyber security protocols, and the price per square metre down to the cent.

This brings a new danger - the Russian Doll effect.

These big occupiers want their own branding, their own security, and their own meeting rooms inside your space.

They are building offices within offices.

If we aren’t careful, we risk becoming glorified landlords,

losing the very community vibrancy that made us valuable in the first place.

And let’s not forget the Vacancy Cliff this introduces.

When a freelancer leaves, you lose a desk.

When an Enterprise client walks,

you can lose >30% of your revenue overnight.

That is a level of risk that requires serious operational maturity to manage.

The Geography Myth: Commutes vs. Cash

We spent years convincing ourselves that city workers would flock to suburban hubs to save a commute.

We were wrong.

People don’t work from home to save time,

they work from home to save money.

If a worker has to pay for a desk in the suburbs,

they’d rather stay in their kitchen.

But the suburbs are booming, just not for the reasons we thought.

The real growth in suburban and regional markets is coming from local SMEs.

It’s the local accountant, lawyer, or recruitment firm upgrading from a dusty C-grade lease to premium flex space.

This is Amenity Arbitrage.

They are trading up for better tech,

better coffee,

and a better image,

without the capital expenditure of a fit-out.

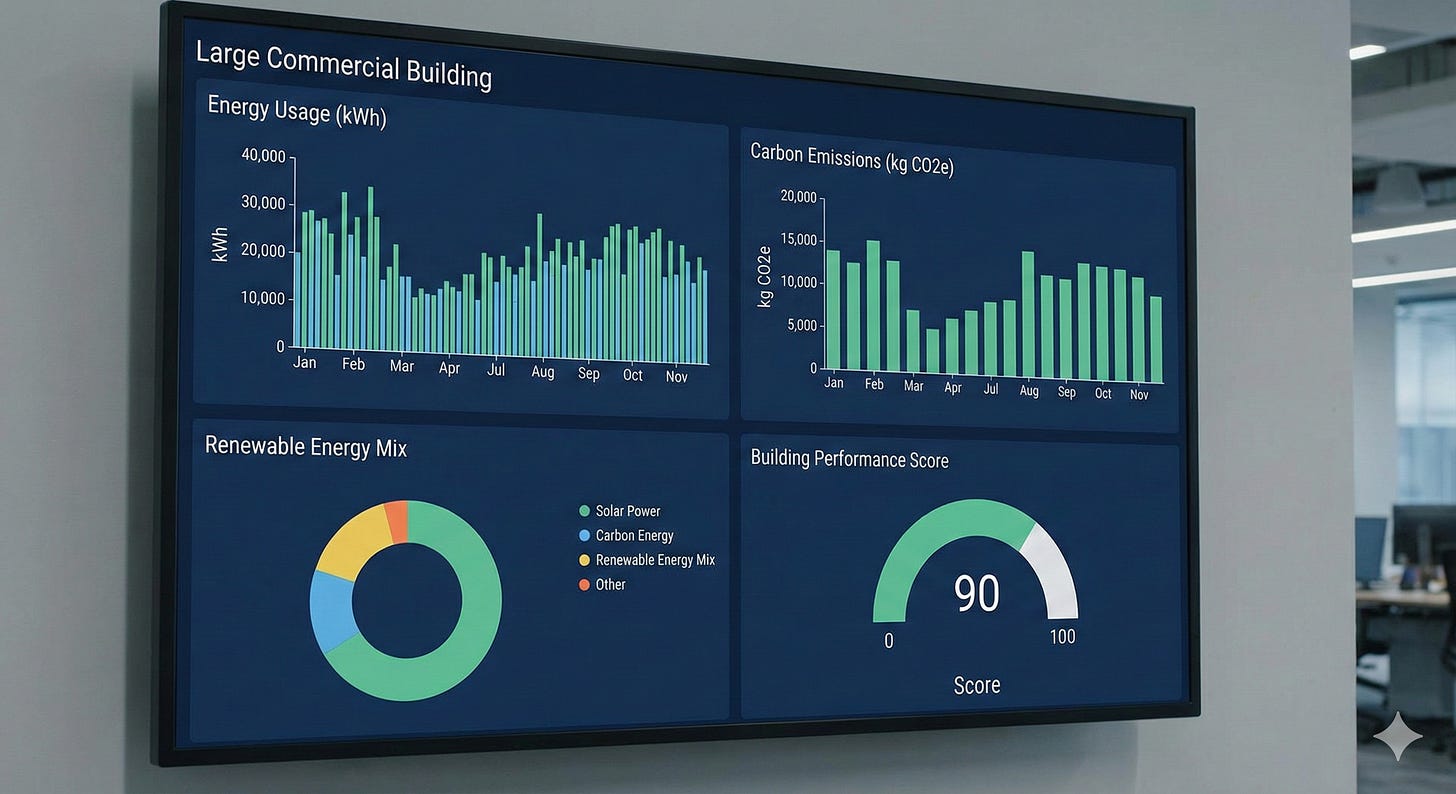

The ‘Green’ Guillotine: ESG or Die

Sustainability is no longer a marketing slide, it is a license to operate.

For those big Enterprise clients I mentioned, reporting on Scope 3 emissions is now mandatory in Australia.

If you, as the operator, cannot provide granular data on the carbon footprint of their suite - energy usage, waste, procurement - you are not just annoying, you are a liability.

Carbon Neutrality, B-Corp certification, WELL Ratings, NABERS ratings - the list goes on - aren’t badges of honour anymore, they are risk mitigation strategies for your customers.

If you can’t provide the data, you won’t just lose the deal,

you won’t even make the shortlist.

Workspitality: The Hotelification of the Office

We have talked about ‘hospitality’ in workspace for years,

but 2026 is where the rubber hits the road.

The desk is dead as the primary unit of value. The new currency is experience.

This is the age of Workspitality (thank you to my friend Domino Risch for this excellent smashing together of words).

The Community Manager is no longer just there to organise Friday drinks; they are a Concierge.

The expectation is now seamless, high-touch service that rivals a boutique hotel.

Having nice furniture is table stakes.

To compete today we have to anticipate needs.

It’s about understanding that our customers have a choice,

lot’s of choices in fact!

If our workspace experience isn’t better than their living room, or the multiple competitors down the road, they simply won’t come.

We are in the business of earning the commute, every single day.

The Boring AI Revolution

Forget AI writing poetry or generating quirky marketing images (although I note here that the images in this article were generated by Google Gemini…!).

In the flexible workspace sector,

AI has finally found its calling,

and it is beautifully boring.

The real revolution is in the back office.

It’s AI managing HVAC systems to optimise energy usage in real-time.

It’s automated billing that actually works.

It’s lead qualification bots that filter out the tyre-kickers before they waste your sales team’s time.

We are seeing a divergence:

High-Tech for Low-Touch tasks,

and High-Touch for High-Value tasks

By handing the drudgery of operations over to AI, we free up our human teams to do what they do best: build relationships and deliver that Workspitality.

Conclusion: The Death of the Average

As we look at the year ahead, the market has ruthlessly bifurcated.

On one end, you have the Premium Giants:

Global operators with the scale to serve the Enterprise market.

On the other, you have the Niche Local Heroes:

Pperators who know their neighbourhood and their customer better than anyone else.

The danger zone is the ‘Squeezed Middle’.

If you are running 50–100 desks with a mediocre fit-out, no clear differentiator, and no operational scale, you are in trouble.

You cannot compete on price with the giants, and you cannot compete on community with the locals.

2026 is the year of Operational Grit.

It’s not about being the biggest or the flashiest.

It’s about being the most efficient, the most compliant, and the most human.

The party is over, but the real work - and the real value - is just beginning.

Excellent framing of the market bifurcation. The "Squeezed Middle" analysis is spot on, that 50-100 desk range with no clear differentiation is basically a no mans land right now. Been watching this play out in real time where mid-sized operators either scale up agressively or pivot hard into niche positioning. The Enterprise client vacancy cliff risk is something most folks underestimate imo.