Flex Is the Backbone of the Brave Economy: Why Businesses Are Doubling Down in Uncertain Times

Part 1 of 4 · Q3 Rubberdesk Report: Flex Is the Backbone of the Brave Economy

The economy may be uncertain, but bold businesses are not waiting for stability, they are building it. And they are doing it through flexible office space.

The data speaks volumes

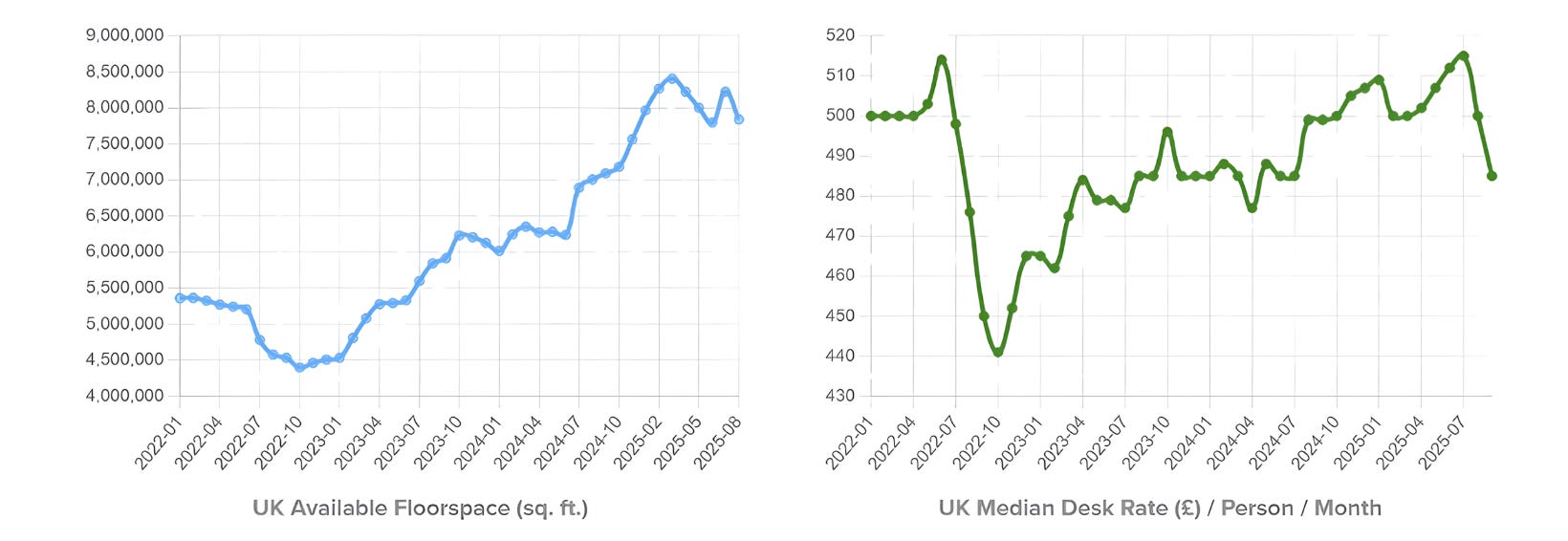

Rubberdesk’s Q3 2025 report reveals a market that is not just resilient but accelerating. Available flexible office space dropped 2.3% to 7.75 million SqFt, with take up in Lond…